Table of Content

Remember that assets cannot be gifted or sold under fair market value, as it violates Medicaid’s look back rule. When “spending down”, it is best to keep documentation of how assets were spent as evidence the look back period was not violated. For Texas residents, 65 and over, who do not meet the eligibility requirements in the table above, there are other ways to qualify for Medicaid. CMS DISCLAIMER. The scope of this license is determined by the ADA, the copyright holder. Any questions pertaining to the license or use of the CDT should be addressed to the ADA.

The amount Medicaid will pay towards in-home care varies based on the state and the Medicaid program in which one is enrolled. Some programs may cover the cost of a personal care assistant several hours a day / several days a week, adult day care a few days per week, or respite care a couple of times per month. States may also offer home and community based services via Section 1115 demonstration waivers. These pilot programs allow states greater flexibility in implementing and improving their Medicaid programs.

HCBS Funding in the American Rescue Plan Act

Examples include one’s home, household furnishings, vehicle, and engagement and wedding rings. There are also planning strategies, such as Miller Trusts, Medicaid asset protection trusts, irrevocable funeral trusts and annuities, that can be implemented in order for one to meet the financial eligibility criteria. Professional Medicaid planners can be of great assistance in this situation. For these programs that are part of the states’ regular Medicaid program, there is no waitlist. This is because original Medicaid is an entitlement and all persons who meet the eligibility requirements will receive benefits.

This may include the home of a friend or relative, an adult foster care home, or an assisted living residence. The exact settings in which one can receive services depends on the state and the Medicaid program. Yes, Medicaid will pay for in-home care, and does so in one form or another, in all 50 states. Traditionally, Medicaid has, and still continues to, pay for nursing home care for persons who demonstrate a functional and financial need. However, in-home care provides an alternative for seniors who require assistance to remain living at home, but prefer not to relocate to nursing home residences. In-home care via Medicaid not only helps elderly persons to maintain their independence and age at home, but is also a more cost-efficient option for the state than is paying for institutionalization.

VIII. How to Find a Home Care Provider in Texas

Percentage of clients with documented evidence of agency refusal of services with detail on refusal in the client’s primary record AND if applicable, documented evidence that a referral is provided for another home health agency. Based on the agency’s perception of the client’s condition, the client requires a higher level of care than would be considered reasonable in a home setting. The agency must document the situation in writing and immediately contact the client's primary medical care provider. In Texas, nursing home care costs an average of $5,125 per month, making it the most expensive senior care option.

Problems that can be treatable if detected by a doctor and caught early, such as many infections and cancers, can become fatal or life-altering if they are allowed to progress unchecked. Uninsured children are only one-third as likely to have all their vaccinations for preventable diseases. Chronic illnesses, such as diabetes and asthma, may go untreated and affect a child’s performance in school. HHSC submitted an initial spending plan to the Centers for Medicare and Medicaid Services on July 12, 2021.

Services:

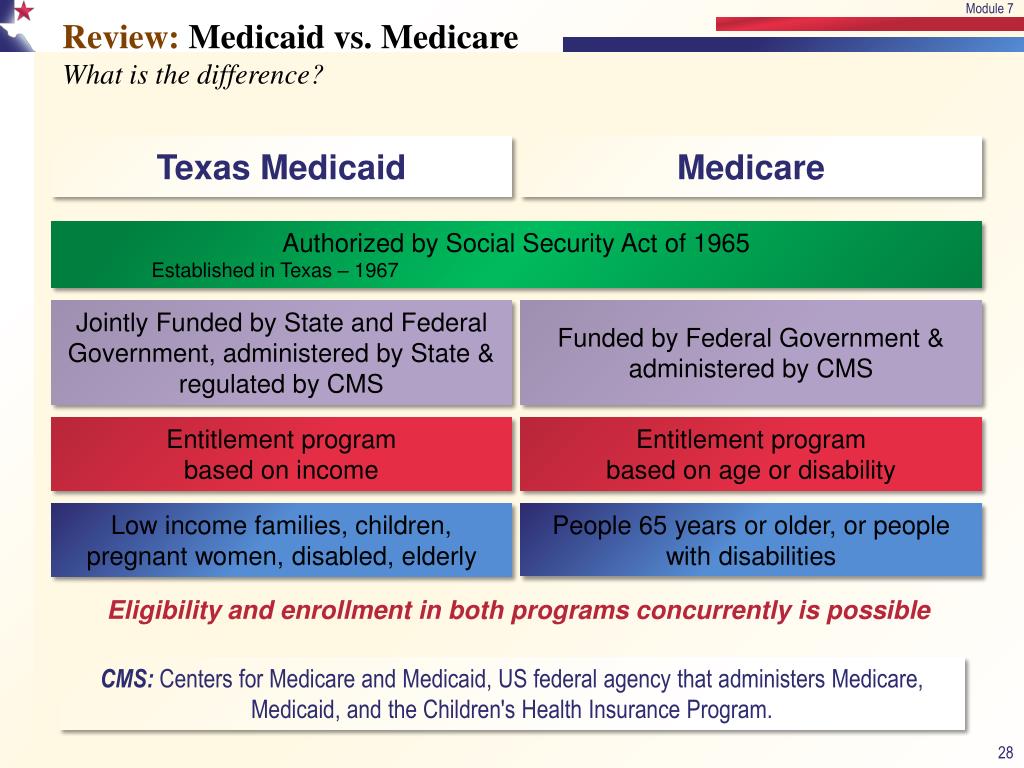

A new applicant that wants to obtain a contract to provide Texas Health and Human Services LTC Medicaid services must enroll in Texas Medicaid. In March 2014, the Centers for Medicare and Medicaid Services issued the federal HCBS Settings Rule which added requirements for settings where Medicaid HCBS are provided. Income is counted differently when only one spouse applies for Regular Medicaid; The income of both the applicant spouse and non-applicant spouse is calculated towards the applicant’s income eligibility. Examples include employment wages, alimony payments, pension payments, Social Security Disability Income, Social Security Income, IRA withdrawals, and stock dividends. Covid-19 stimulus checks and Holocaust restitution payments do not count as income and have no impact on Medicaid eligibility. 1) Institutional / Nursing Home Medicaid – This is an entitlement program; Anyone who is eligible will receive assistance.

One such alternative, made possible by the Affordable Care Act, is the Community First Choice option. CFC allows states to offer in-home personal attendant services to assist with one’s activities of daily living and instrumental activities of daily living . Examples include help with grooming, mobility, toiletry, preparing meals, light housecleaning, etc. for persons who would otherwise require placement in nursing homes. At the time of this writing, nine states have implemented the CFC option. These states are Alaska, California, Connecticut, Maryland, Montana, New York, Oregon, Texas, and Washington.

The agency may discontinue services or refuse the client for as long as the threat is ongoing. Any assaults, verbal or physical, must be reported to the monitoring entity within one business day and followed by a written report. Percentage of clients with documented evidence of needs assessment completed in the client’s primary record. Medicaid reimbursement in Texas isn’t possible if the caregiver agency isn’t a certified HHA . The agency must be certified along with having a license to deliver care services within the state.

Reimbursement rules applicable to Home Health Agencies are located at Title 1 of the Texas Administrative Code, Part 15, Chapter 355, SubChapter J, Division 2, Rule 8021. The Home Health Agencies program rules are located at Title 1 of the Texas Administrative Code, Part 15, Chapter 354, SubChapter A, Division 3, Rule 1031, 1033, 1035, 1037, 1039, 1041, and 1043; Division 11, Rule 1185. Use of this content by websites or commercial organizations without written permission is prohibited. This site is for information purposes; it is not a substitute for professional legal advice. Consumer directed caregivers are paid an hourly rate, which is approved by Medicaid for in-home care. This rate varies by state and program, and is generally a few dollars per hour lower than is the market rate.

In-home care services may be available via one’s regular state Medicaid plan, but may also be offered through Home and Community Based Services Medicaid waivers or Section 1115 demonstration waivers. In March 2014, the Centers for Medicare and Medicaid Services issued the federal HCBS Settings Rule, which added requirements for settings where Medicaid HCBS are provided. CMS has given states until March 17, 2023 to bring Medicaid programs into compliance with the regulations. CPT is provided "as is" without warranty of any kind, either expressed or implied, including but not limited to the implied warranties of merchantability and fitness for a particular purpose. Fee schedules, relative value units, conversion factors and/or related components are not assigned by the AMA, are not part of CPT, and the American Medical Association is not recommending their use. The AMA does not directly or indirectly practice medicine or dispense medical services.

Detailed information regarding the requirements is offered by the Bureaus of Licensing and Certification. Whether aiding with recovery or managing a chronic illness, our Home Health Services can help you or your loved one achieve optimal levels of health and independence, wherever you call home. We offer extra benefits to help make a difference in your life, with things like extra transportation services, reward programs for completing healthy activities, and Boys & Girls Club memberships for kids. Learn more information about HHSC provider enrollment process and requirements. Rules regarding minimum standards for HCSSA licensure can be found in Title 26 Chapter 558of the Texas Administrative Code.

No comments:

Post a Comment